M&A Deal Insight Report

2024

Welcome to our first M&A deal insight report, which explores deal terms and trends in the M&A and private equity markets. We believe this report offers comprehensive analysis covering mainly lower and mid-market deals, providing valuable insights for both buyers and sellers.

In 2024, macroeconomic factors and shifting investor sentiment continued to influence dealmaking, but cautious optimism is emerging as slowing inflation may lead to stabilised interest rates. Activity levels in Q3/Q4 2023 have remained consistent into 2024, with the lower and mid-market proving more active than the larger/upper market. While the appetite for large platform acquisitions has slowed, bolt-on acquisitions remain a priority for private equity firms, as they focus on consolidating existing investments and leveraging creative deal structures and sector-specific strategies to sustain deal activity.

scroll

REPORT SNAPSHOT

Average deal value:

_

£28.2m

Aggregate value –

acting buy-side:

£1.014bn

Aggregate value –

acting sell-side:

£567.5m

REPORT SNAPSHOT

Our deal sample included in this report contains 56 reportable share purchase agreements that completed in the year to September 2024.

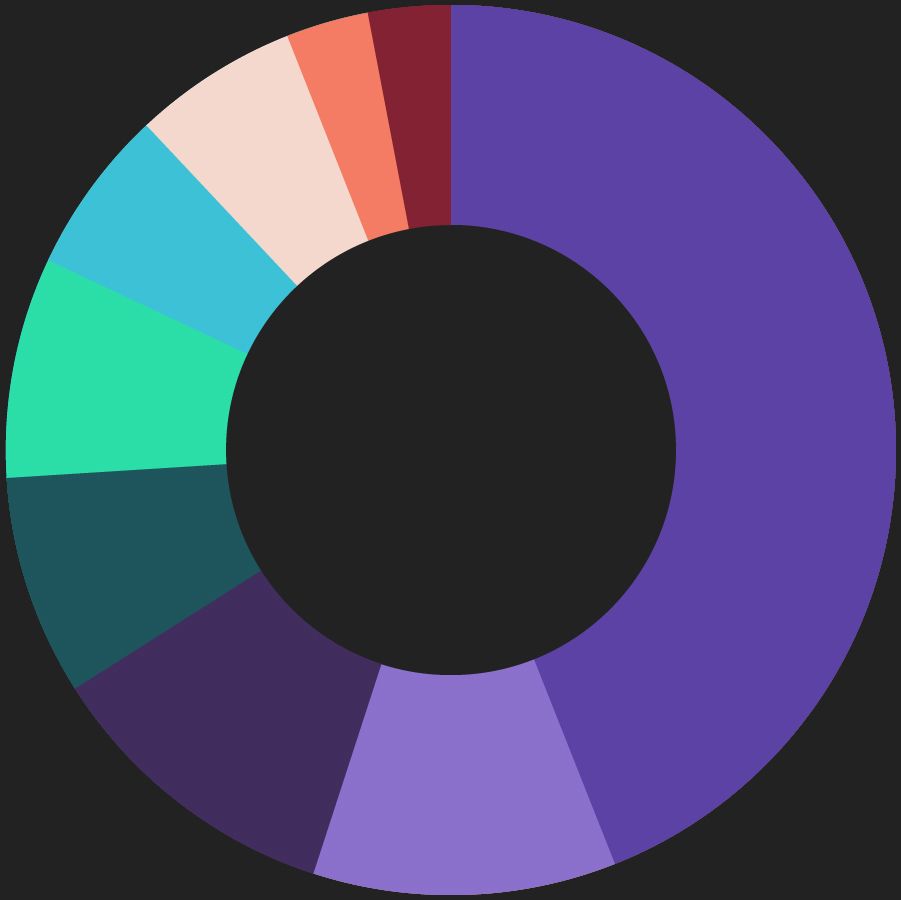

Of our surveyed deals, private equity accounted for 64% of deal volume and 49% of deal value; trade accounted for 36% by number and 51% by value.

The technology sector dominated deal volumes, representing one-third of the total volume covered in the report, followed by deals in the healthcare and life sciences and financial services sectors.

PRIVATE EQUITY SNAPSHOT

Aggregate private equity deal value:

£776.4m

Average private equity platform deal value:

£77.2m

Average private equity bolt-on deal value:

£12.6m

PRIVATE EQUITY SNAPSHOT

Only 3% of private equity deals were subject to an auction process.

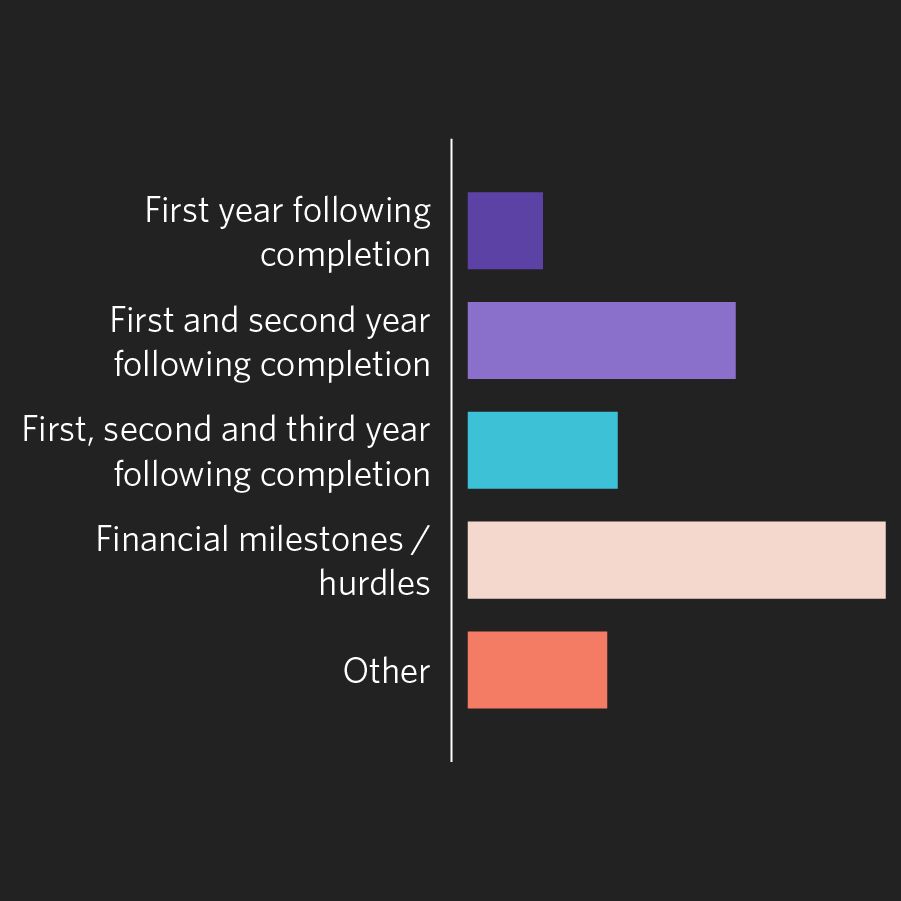

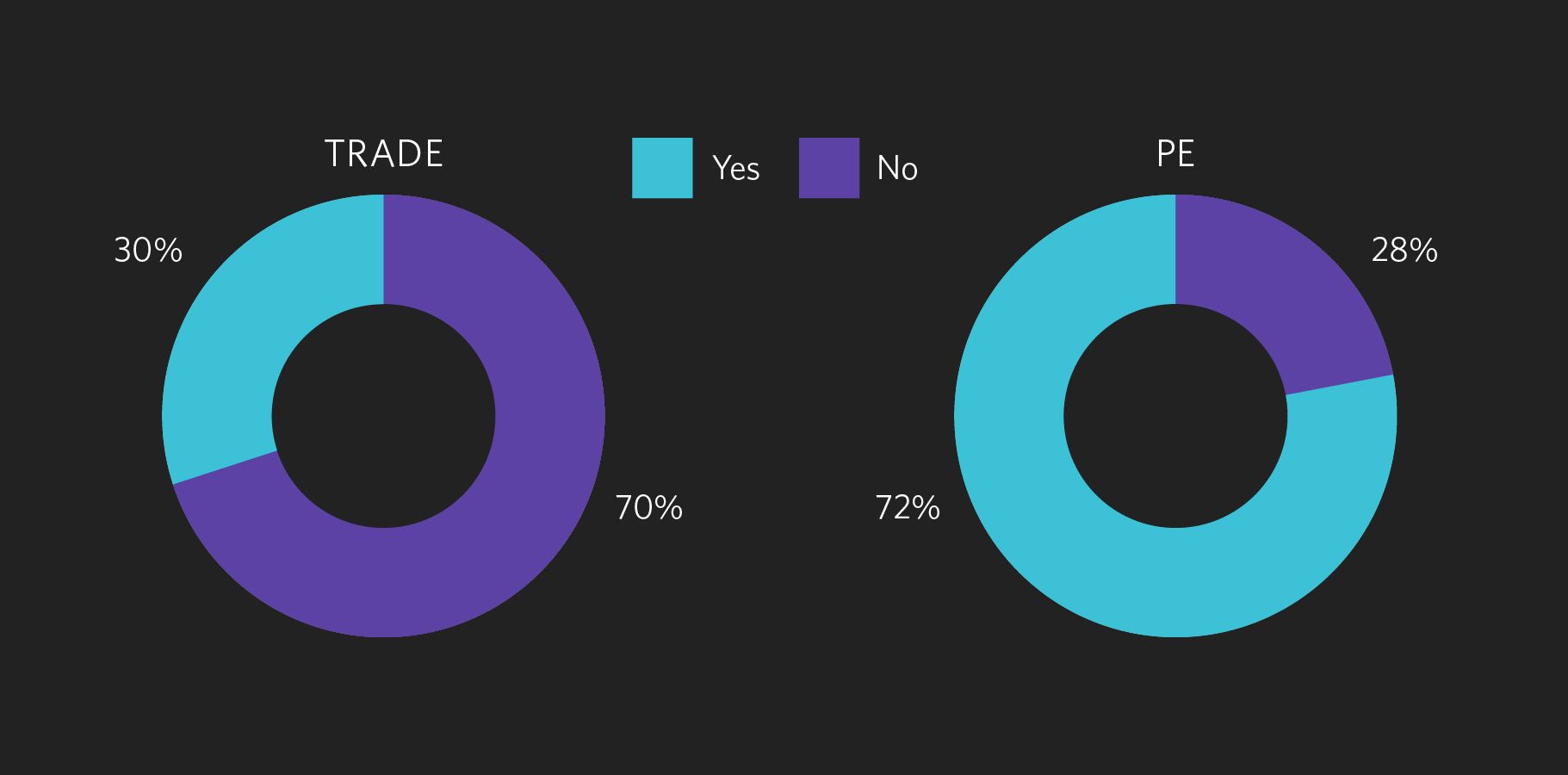

Deferred consideration structures were infrequently used in platform deals, but were commonly used in bolt-on deals, 67% of the time.

Revenue-based targets as a basis for payment of deferred consideration was the most common measure (53% of the time) whereas only 11% of private equity deals had EBITDA targets as a measure for calculating the value of deferred consideration.

1 in 4 private equity deals featured W&I.

Where a warranty cap of less than 100% was agreed for general warranties, there was a higher cap set for tax claims. There was a correlation between deal value and the warranty cap percentage – as the deal value increased, we observed a clear trend of reduced warranty cap.

TRADE SNAPSHOT

TRADE SNAPSHOT

Burness Paull acted buy-side on 55% of trade deals.

15% of Trade deals were subject to an auction process.

Deferred consideration was used in 45% of trade deals.

Achievement of EBITDA targets as a measure for calculating the value of deferred consideration was the most common measure (around 50% of the time). Bespoke company specific targets were the second most common (such as sales growth).

There has been an increased prevalence in the use of W&I to give sellers a zero-recourse exit. Across all trade deals, W&I was in place on 35% of deals and most commonly on deals with a higher value - more than 50% of the time for deals £12m+.

CONSIDERATION

Deferred v 100% paid at completion

scroll

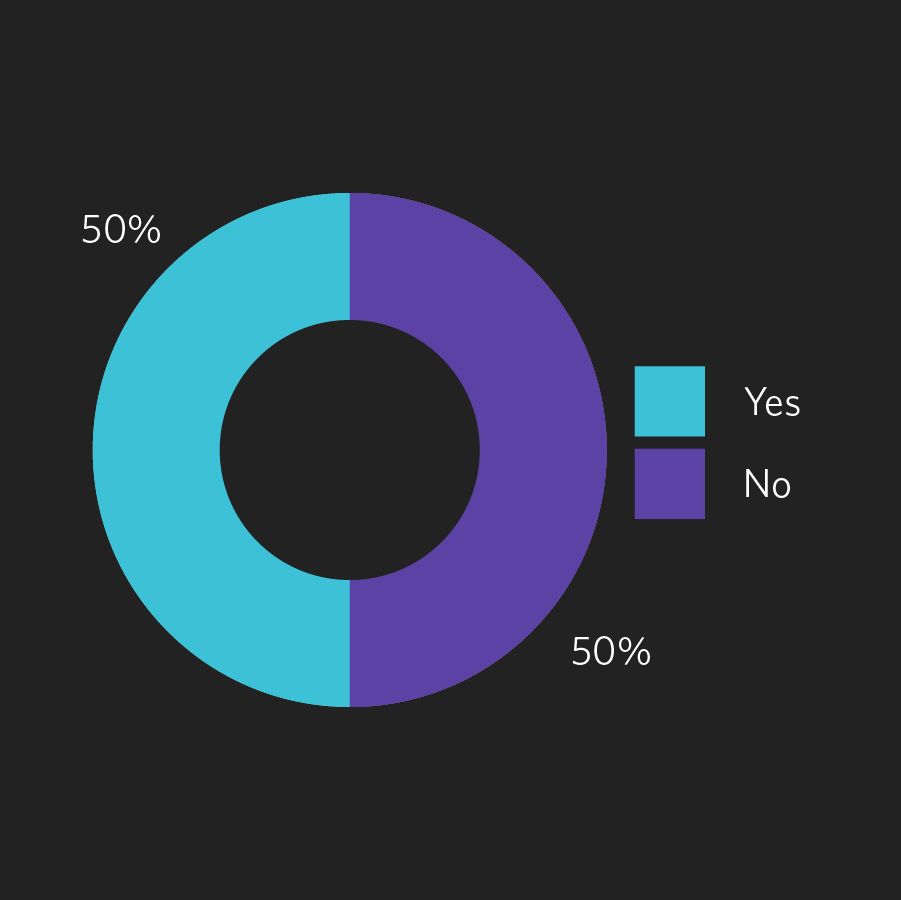

Deferred consideration remains a popular means of bridging valuation gaps, particularly in private equity deals.

It featured less when the business being purchased was more mature and therefore there was more clarity around value.

For deals with a value up to £12m we saw deferred consideration used more often – the average was 60% versus only 40% when the deal value was greater than £12m.

It is clear investors are exercising more control with deferred consideration leaver provisions in-play more than half of the time.

Cash was the sole form of deferred consideration 96% of the time.

Consideration type varied when there was not a deferred element. 61% of the time it was cash only, with other forms of consideration being a combination of cash, loan notes and equity.

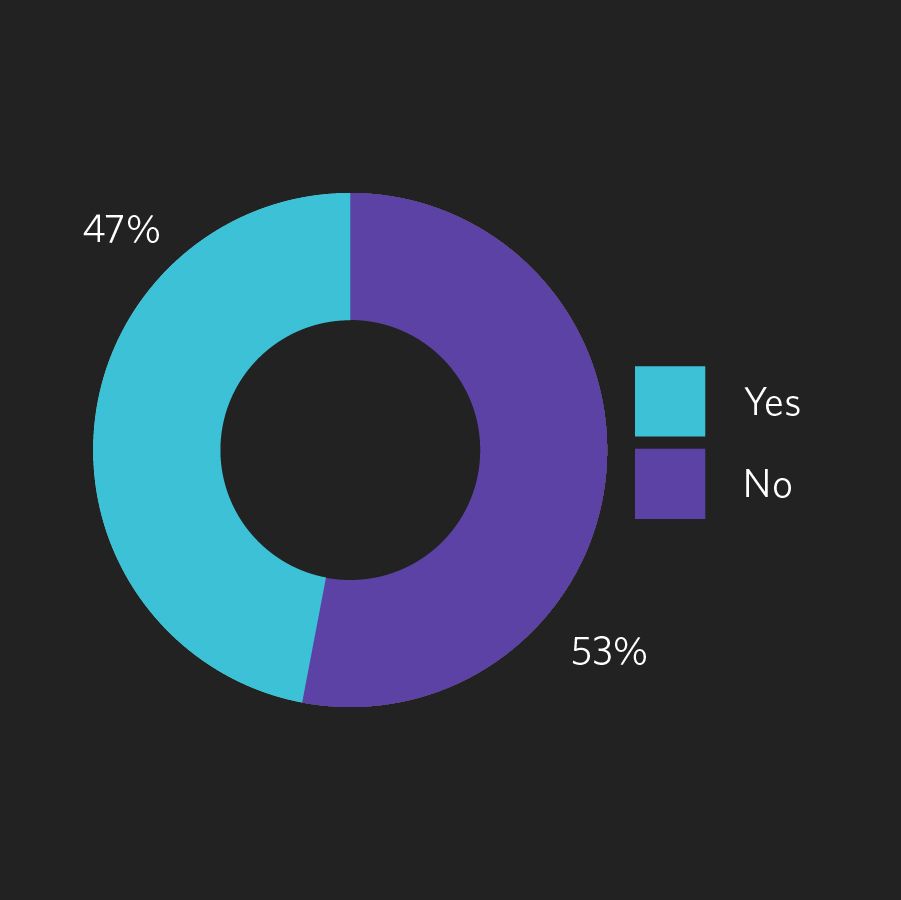

Was the consideration structure to be paid, either partially or entirely, through deferred payments?

VALUATION AND COMPLETION

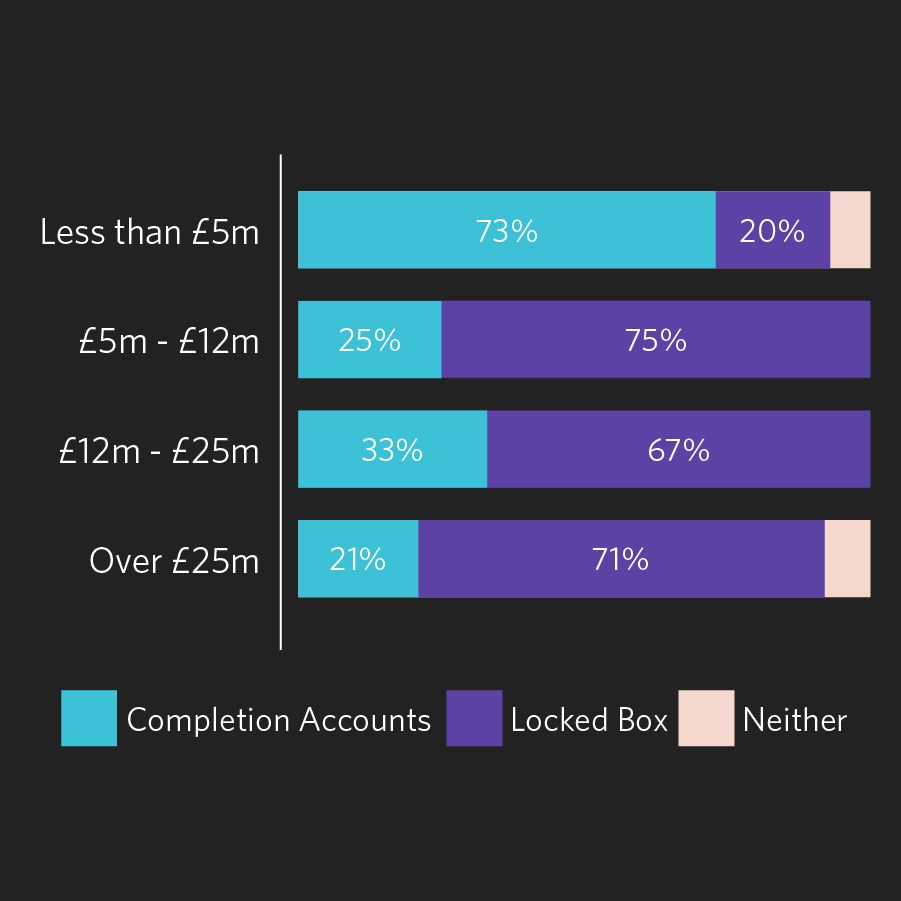

_____________Proportion of deals using a locked box mechanism

Locked Box v Completion Accounts

Strong use of completion accounts for deals with a value of £5m or less. A locked box mechanism is more frequently used on higher value deals and in private equity deals.

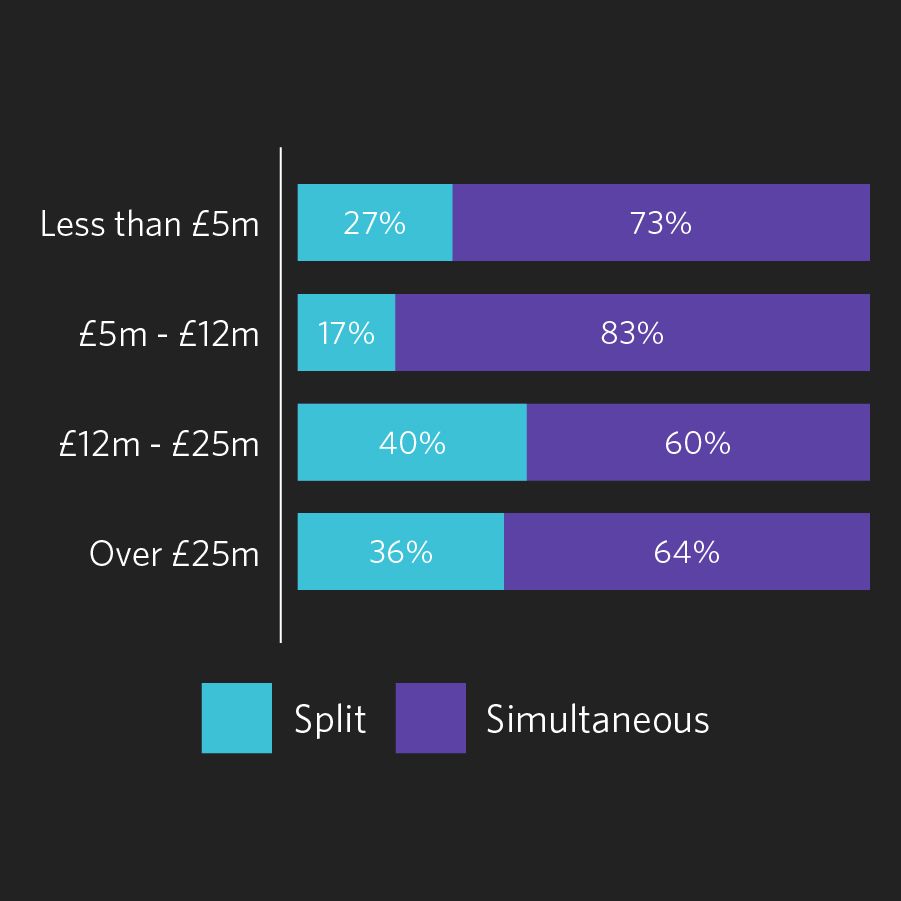

Split Exchange and Completion

Trade deals saw a somewhat higher proportion of deals with a simultaneous signing as opposed to private equity – 85% v 61%.

OTHER DEAL TERMS

Were the warranties repeated at completion?

Warranties at both exchange and completion were more common for trade deals than PE (67% v 43%).

Repeated warranties occurred more frequently for deals up to £12m in value and far less frequently for deals with a higher value.

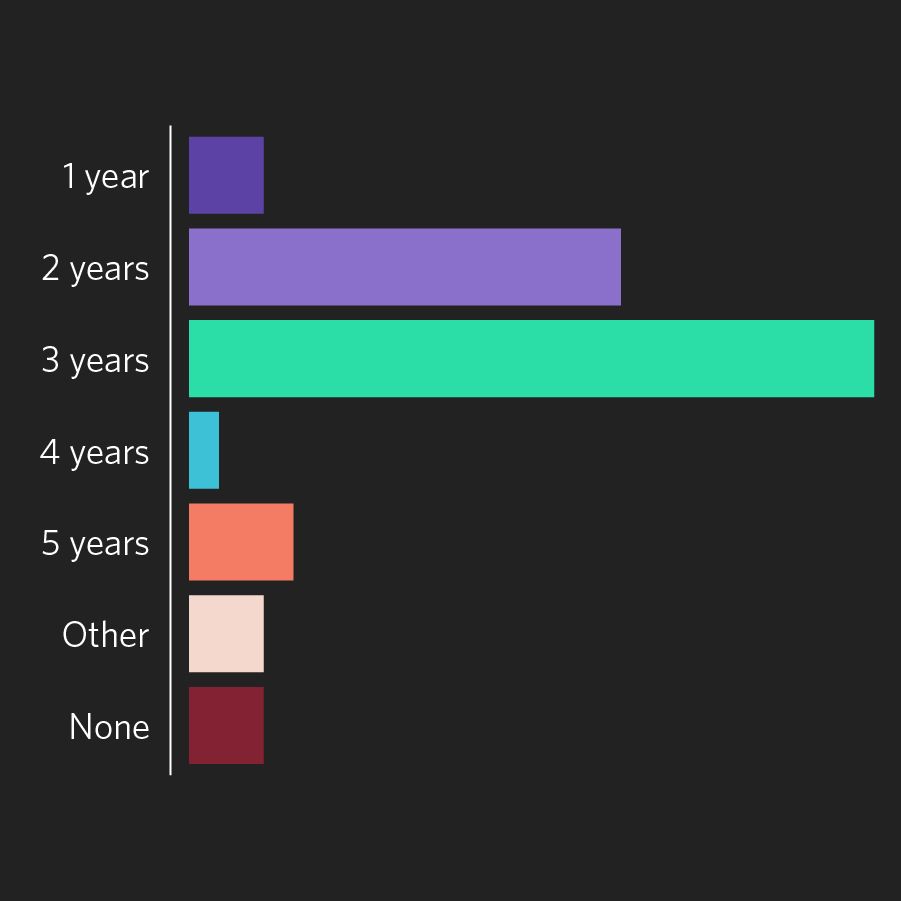

|

SPLIT SIGNING |

BOTH |

EXCHANGE |

|---|---|---|

|

Less than £5m |

75% |

25% |

|

£5-£12m |

100% |

0% |

|

£12-£25m |

50% |

50% |

|

Over £25m |

0% |

100% |

CONTACT

Grant Stevenson

PARTNER

grant.stevenson@burnesspaull.com

+44 (0)141 273 6721

Grant is a highly experienced M&A and private equity partner in our Corporate Finance Division. Grant has an outstanding reputation in the national deals market and is an expert in advising investors, portfolio companies and management teams on private equity transactions.

Daniela Pallucci

SENIOR ASSOCIATE

daniela.pallucci@burnesspaull.com

+44 (0)131 473 5550

Daniela has spent her entire career with Burness Paull and has specialist expertise in private equity and private M&A. She advises several of our largest private equity backed businesses on their buy and build strategies.